We Connect

All Solutions

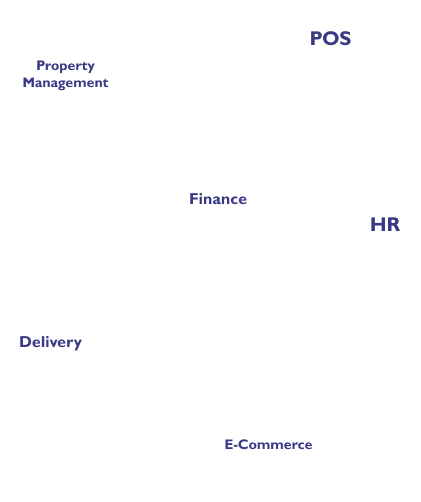

Reachware is an Integration Platform as a service (IPaaS) that enables systems to talk seamlessly with each other and allows separate SaaS systems to function as a unified ecosystem.

Integrate All Your Solutions Together

The Only Leading IPaaS in the Middle East

About Reachware

Improving Customer Service

The faster and more efficiently you meet your customers' needs

Increase Sales

Make it easier for customers to purchase your products or services.

Productive Environment

There will be more time to be spent on non-technical activities

Information Appears Faster

The important information is available faster throughout organizations.This allows quick decisions to be made.

Consistent Connection

Integrating these systems removes the confusion that inconsistent information creates.

Saves you Money and Hassle

Instead of replacing several existing systems with one big and expensive one, integrate these systems at a lower cost.

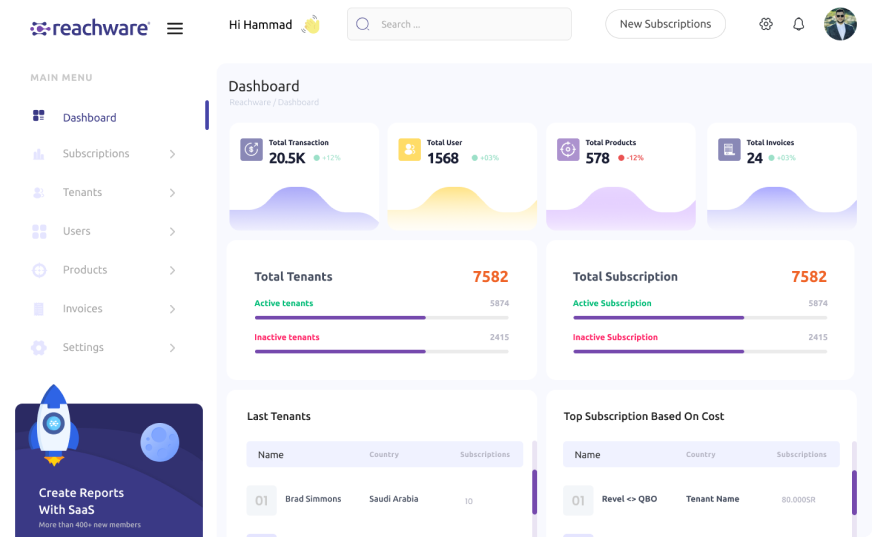

Reachware in numbers

+50

Cutomers

+100

Active Subscriptions

+1500

Flows

+5000

Transactions

+50M

System

We are happy for our customers Trust

Reachware Extensions

SuiteLoyalty

Bank Integration

ISSA - Inventory - Store Suite App.

Basher HR

Car Lease

Property Managment system PMS

Reachware integrates with

What makes us different?

Our Clients